Whatever point of sale system you use it should deliver a specific code number along with the decline receipt but that won t help give you the why without having the definitions of those codes.

Credit floor error message.

The floor limits usually come into.

Response codes received that are not in this table should be treated as a general error not approved.

Function not permitted to cardholder.

Avenue 5 building rose ave 2nd floor.

The new method when you make a payment for your internet accounting use apart from adding the payment to your credit limit we now also set another field in the system called the credit floor.

I have 2000 usd on the card.

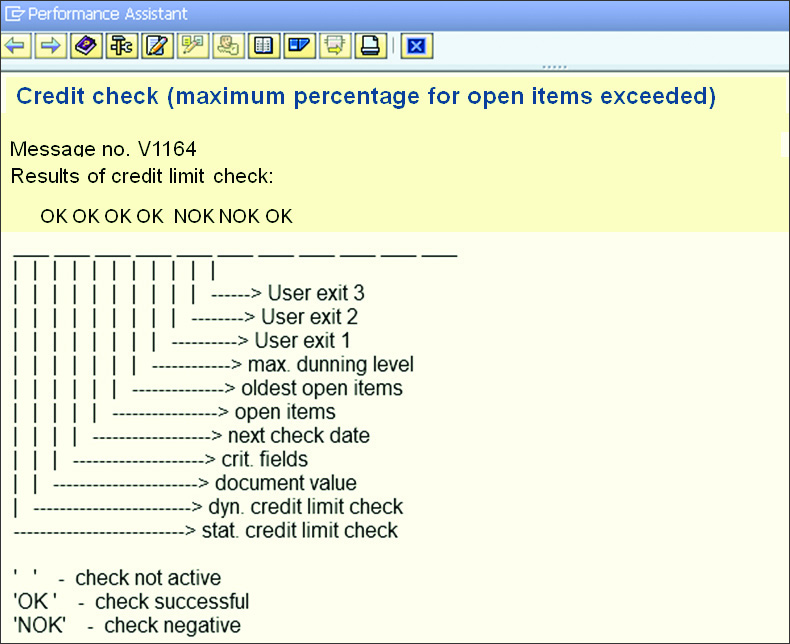

Credit floor 303 generic decline 401 call 402 default call 501 pickup 502 lost stolen 503 processor declined 510 processor declined 521 over credit limit 522 card expired 530 do not honor 531 couldn t reach the bank 570 stop deposit order 571 revocation of auth 572 processor declined 591 invalid cc number 592.

Credit card statistics say that as of july 2020 there are 1 06 billion credit cards in use in the united states of america alone and 2 8 billion credit cards in use worldwide.

The issuing bank has declined the transaction as this card cannot be used for this type of transaction.

Credit cards can be declined for numerous reasons.

Message reads we encountered a paymentech problem.

For a charge above the floor limit the merchant must obtain authorization from the card issuer.

The transaction is declined by the issuer as the credit card number doesn t exist.

While an increased spend on credit cards has led to a surge in the number of e payments being processed every day it has also given rise to some challenges for the users and businesses alike.

A zero floor limit means every credit card transaction has to be authorized.

Declined credit cards are a common occurrence in any business environment but they are especially common in b2c high transaction volume companies.

In credit card purchases the maximum amount the merchant can charge to the buyer s card without getting authorization.

The customer should use a separate credit card.

It is set to the value of your balance truncated to whole dollars at the time of payment.

Total merchant concepts provides the most common codes along with the response reason.

Ask the customer for using another card or contacting their bank.